- Cost turbo tax business and home for free#

- Cost turbo tax business and home full#

- Cost turbo tax business and home software#

- Cost turbo tax business and home professional#

- Cost turbo tax business and home free#

It provides users with one federal and one state tax return, completely free, with accuracy and maximum refund guarantees.

Cost turbo tax business and home free#

*Get unlimited help from live tax experts starting at $39 and an additional fee for state taxes.Ĭash App Taxes - formerly known as Credit Karma Tax - debuts this tax season with a fully free tax preparation option that doesn't skimp on available IRS forms and schedules.

Cost turbo tax business and home full#

Learn more in our full H&R Block review for 2022

Cost turbo tax business and home professional#

If you decide midway through your online tax return that you'd rather not do it yourself, H&R Block has about 9,000 offices across the US to set up an appointment or drop off your taxes for a professional to complete. One big appeal of H&R Block is the existence of brick-and-mortar offices.

Cost turbo tax business and home software#

Its online software also lets you upload files like multiple 1099 forms, schedules A and C, gifts to charity and medical expenses, among a list of many items.

Cost turbo tax business and home for free#

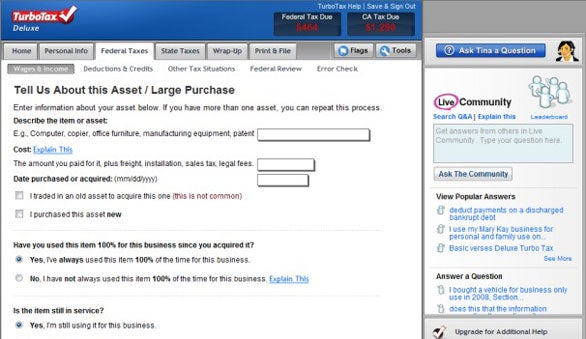

H&R Block's Online Assist - an add-on that costs $40 for Free Online and Deluxe and $60 for Premium and Self-Employed - provides virtual tax assistance from a professional online, including screen sharing to show exactly where you're stuck.Ī nifty photo capture lets you quickly upload your W-2 to H&R Block and get your tax return rolling. Help screens and FAQs are comprehensive, though not as easy to access. While not as smooth as TurboTax, H&R Block features a well-designed, interview-style system that helps users sidestep potential mistakes. H&R Block compares well with our top pick, TurboTax, and it shines in its Free Online version, which covers simple returns as well as deductions for student loans and tuition fees - a perfect fit for filers without complicated tax situations who also want educational tax breaks. *Up to $49 per state return with TurboTax Live and Live Full Support Free to $389 for TurboTax Live Full Support.Learn more in our full TurboTax review for 2022 TurboTax's comprehensive benefits come with a higher price tag than other tax software, but peace of mind could be worth the cost. We recommend the Deluxe level at $78 for most filers if your taxes are even slightly complicated, but if you know you don't qualify for most deductions or credits, stick with Basic for free.Įxpert support from TurboTax Live can supplement any of the TurboTax products, as can TurboTax Audit Defense. When questions arise, information is quickly at hand.įour TurboTax products - Basic, Deluxe, Premier and Self-Employed - cover the range of taxpayers. TurboTax guides you deftly through the process of completing your tax return, never asking for information you've already given or that doesn't apply to your tax situation. The software combines tax expertise and an easy user experience with an accessible interface. TurboTax by Intuit is our clear front-runner for good reason. Read on to learn more about features, experience and prices to decide which could work best for you. TurboTax, H&R Block, Cash App Taxes, Jackson Hewitt, TaxSlayer, TaxAct and FreeTaxUSA all make our list of best tax software this year. The best tax software of 2022 can handle all the complications that the IRS can throw at it and leave you satisfied with your maximum refund, or at the least a correct amount that you owe. Whether you have a bit of breathing room or not, there's no good reason to procrastinate. You're losing out on money if you're owed a tax refund, and tax penalties and interest will grow if you owe the IRS. 15 to complete and file your tax return.įor those taxpayers who don't have extensions and are currently late on their 2021 taxes, you should file your tax return as soon as possible.

And if you filed a tax extension on time, you've got until Oct. Some Americans affected by disasters like wind storms, tornadoes and wildfires have deadlines of May 16 or June 15. The tax deadline for most Americans - April 18 - has come and gone, but that doesn't mean your tax return is necessarily late. This story is part of Taxes 2022, CNET's coverage of the best tax software and everything else you need to get your return filed quickly, accurately and on-time.

0 kommentar(er)

0 kommentar(er)